Image credit: The Creation

The future of insurance

What’s the future of insurance? A big question with multiple answers that insurers and insurtechs alike are trying to decipher. While we can’t know for sure the future of insurance, we know one thing:

“The insurance of the future will be more engaging, more interactive and more like a consultant”, wise words from Bradley Collins, Chief commercial officer at Insurtech Insights.

The future of insurance will be digital. That much is certain. And one of the key reasons for this trend is that great customer experience is still lacking in insurance. In an era where we are used to having instant everything, insurance companies are still struggling to offer а seamless customer experience, and this is where most Insurtechs take the lead. In this case, traditional insurance companies have two options: either build the expertise in-house, or look for strategic partnerships that can help them adopt the latest technology more quickly.

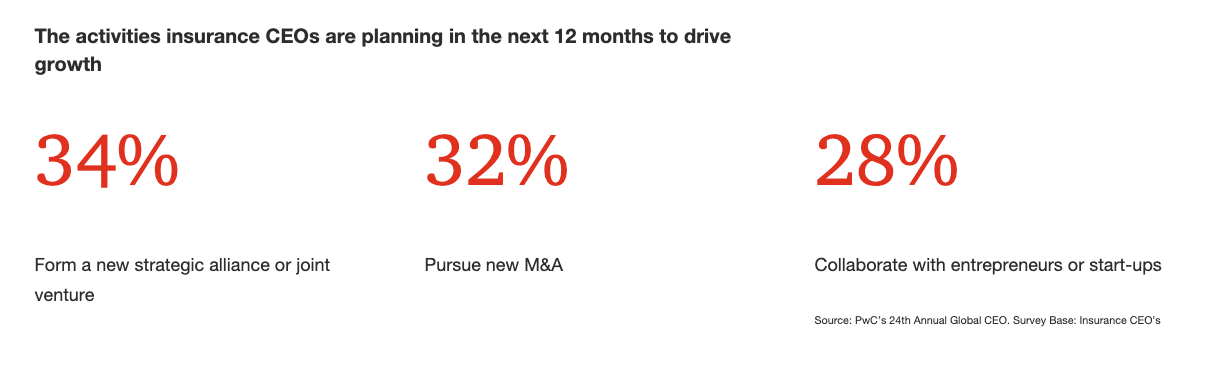

Partnerships between insurers and technology companies are increasingly common

Traditional insurers quickly realised that the way forward with the fast-moving, fast-changing world of startups is to form strategic partnerships. Since 2017, insurance companies and technology companies around the globe have publicly announced more than 180 partnerships. A lot of those are partnerships between Insurers and InsurTechs - Zurich Connect partnered with Yolo, while Generali Global Assistance collaborated with Lyft. And while such partnerships can be useful, insurance companies also need to innovate their offerings too. Even if an insurance & insurtech collaboration is off the table, there’s plenty of lessons traditional insurers can learn from the newly emerging insurtechs.

How to prepare for a digital transformation partnership

-

Have a coherent digital transformation strategy

.png)

Having a coherent digital transformation strategy is first and most essential step when embarking on this journey. If you haven’t checked our blog post about approaching digital transformation the smart way, now is a good time to do so. In a nutshell, start by asking yourself:

What insurance industry problem are you trying to solve?

To make a partnership truly successful, insurance companies must make sure that a tech partnership addresses a specific need and use case. Only by understanding and prioritising the organisation's problems can an insurer find the right partner - the one who can help develop and deliver a solution that the organisation needs and can integrate into its business.

- Gain stakeholder buy-in early on

Before initiating the search for a digital transformation partner, make sure that the relevant business leaders within the enterprise are on board, so that there’s an alignment of incentives and accountability.

A standard procedure is to start by getting buy-in from the senior leadership, especially from CIOs and CTOs, as the new solutions will most probably need to be “plugged in” to the insurance company’s older legacy technology. While winning over the C-suite is vital, you shouldn’t underestimate other business units that might be impacted by the partnership’s solution - such as Claims, Underwriting or Distribution departments. Getting them on board is the first part, but they can also be useful allies as user testers, once the new digital features are ready to be tested.

How to find the right tech partner

Key questions to address

Today it's much easier for insurance companies to find technology startups that offer good value propositions or compelling technologies, because the market has grown immensely in size and maturity. However, the Financial sector, and the Insurance sector in particular, is complex and very dynamic, so you need to make sure your partner is well prepared for the partnership. Here’s a few questions to ask when deciding whether and how to move forward with a partnership:

-

Is the insurtech built to partner with a large insurance company? Have they worked with insurers previously?

-

Do they have the structure, governance, security, and resources to do so successfully?

-

Who are their investors --and how much have they raised? Are they likely to still be in business in the next 6 to 12 months?

-

Are they willing to adjust their offering to meet the insurer's needs?

-

What is their business model? If the partnership scales up, can costs be controlled?

-

Does your company have the technical capability to actually partner with this company (e.g., via cloud, APIs)?

-

Is there a cultural fit with the partnering company?

The importance of cultural fit

Companies often focus their attention on the tech compatibility, financial projections and terms and conditions, while the cultural factor gets left behind. But the truth is, legacy insurance companies and smaller tech-driven companies often have very different ideas about cultural norms for behaviours such as risk tolerance and how decisions are made. Other times, the two organisations might simply have different understandings and values about how technology could be used in the best way.

What made us bond with UNIQA Bulgaria is our full alignment in putting the customer at the centre of our work when designing customer experiences. Once a partnership has been established, it is up to the insurance company to ensure it successfully continues in the intended direction. Coming from our own experience working with UNIQA, there are at least three elements that are crucial for ensuring a successful partnership:

Once a partnership has been established, it is up to the insurance company to ensure it successfully continues in the intended direction. Coming from our own experience working with UNIQA, there are at least three elements that are crucial for ensuring a successful partnership:

Assign a partnership success manager who owns the process and manages the relationship. In our case, Petya, the Digital and Strategic Transformation Director had the vital role of not only setting the direction of the partnership, but also ensuring the communication flow is steady and consistent between the Despark and UNIQA teams.

Develop meaningful metrics to track progress and the value of the partnership’s solution to the business. Using hard data to establish a partnership’s success is important because it minimises the risk of making a subjective decision based on opinions, rather than facts.

Have a plan for scaling the solution. Be prepared to plan how the solution will move through the production, investment and launch, and maintenance phases. Establishing a clearly defined scaling process from the start ensures that there is mutual understanding of what must be achieved in order to keep moving forward.

Ready to shake things up?

As we’ve discussed so far, there are many ways in which digitalisation can be used for the benefit of the insurance industry. Hopefully, we’ve also made a strong case for how it should be harnessed with the right tech partners in hand.

Check out our customised offer for user experience and user interface, specifically made with insurers in mind. We can help you develop a seamless digital experience for both your policyholders and agents that delivers results.