Like many others, the insurance industry is in a state of turmoil. Health insurers are navigating a post-pandemic world, trying to withstand new market entries and the changing consumer behaviours. With high technology adoption, however, new opportunities for insurers are also emerging.

Insurance challenges today

The pandemic

The unprecedented times were difficult for many industries that were forced to shut down, leaving staff jobless and their employers pressed to the wall. The health insurance industry was particularly hit hard - life insurance premiums saw a decline of 6% globally in 2020, and growth and profitability in both annuities and non-term life insurance products is likely to be impacted through 2021 because of low interest rates. Just like in other sectors that operated mostly face-to-face, insurers and insurance brokers were caught off guard when switching to a virtual workspace almost overnight.

Changing customer expectations and lifestyles

On a wider scale, customers of all types are increasingly expecting insurance to be easier, faster, simpler, and more importantly - to be accessible digitally. Millennials, which are currently the largest generation in the workforce, are more than twice as likely to buy insurance online, compared to older customers. Their life stages also shift in time - many of them are delaying or skipping milestones like marriage, children and property ownership, placing a bigger emphasis on products like pet insurance.

New players in the market

InsurTechs and FinTechs are the new kids on the block that have emerged to cater for the new generation’s preferences. While they sell the same products (repackaged as services) and often charge more for them, they draw consumers in through simple, user-friendly customer journeys. Because of legacy architectures and bureaucratic decision making processes, many traditional insurers are struggling to reach the same flexibility and innovation.

How can the insurance industry benefit from digital transformation?

Process Automation and business optimisation

There’s a widespread misconception that implementing digital transformation means entirely rebuilding the tech stack because of incompatibility with legacy systems. But that’s far from true - simple but crucial interventions can lead to massive improvements in operational efficiency, as well as to much more friendly customer experiences.

We are talking about switching to digital forms, adopting electronic signatures, automating data entry and implementing workflow routing - all are small steps that will have a huge impact on the time it takes to process and pay claims. Digitised claims processes and robotics have shown to lower costs by 20-40%, while delivering productivity enhancement.

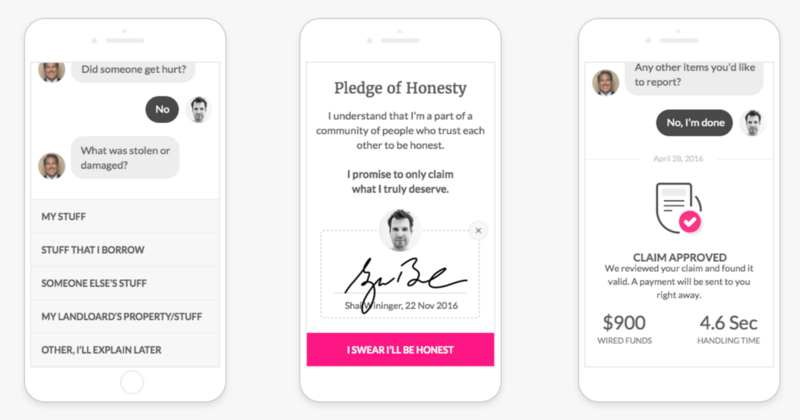

Going one step further, many insurance companies are adopting business rules and bots for handling repetitive tasks, so that employees can focus on more complex cases. Take Lemonade, a U.S property and casualty insurer, where some 30% of claims are handled by the chatbot, AI Jim. Many of the claims are reviewed, approved and paid for in a matter of seconds, while more complex cases are sent to human representatives.

Source: Lemonade

Seamless customer experience

Lemonade’s biggest selling point is simplicity and speed. It all comes down to how the user experiences insurance with Lemonade: the number of clicks (or taps) it takes to sign up, the number of documents needed to verify one’s identity, the ease of finding the information they seek, the time it takes to resolve queries. Frictionless digital experiences are about providing the customer with an integrated, responsive user flow and digital products that are intuitive to use.

So in an era where we are used to having instant everything, a convenient and seamless customer experience is a big differentiator, and this is where InsurTechs and FinTechs beat most incumbents.

Incentives for a healthier lifestyle

Focusing on risk prevention, rather than claims mitigation, is the new strategy many insurers are applying, in order to increase their profit margin. The health and life insurance sectors apply the same logic by rewarding customers for their healthy behaviours.

More and more people are prioritising wellness by embracing preventative care, self-monitoring to keep their bodies and mind in check. Customers now view wellness on a much wider spectrum, ranging from better health, fitness, nutrition to better sleep and mindfulness. And wearable technology and health tracking apps play a big role in that change.

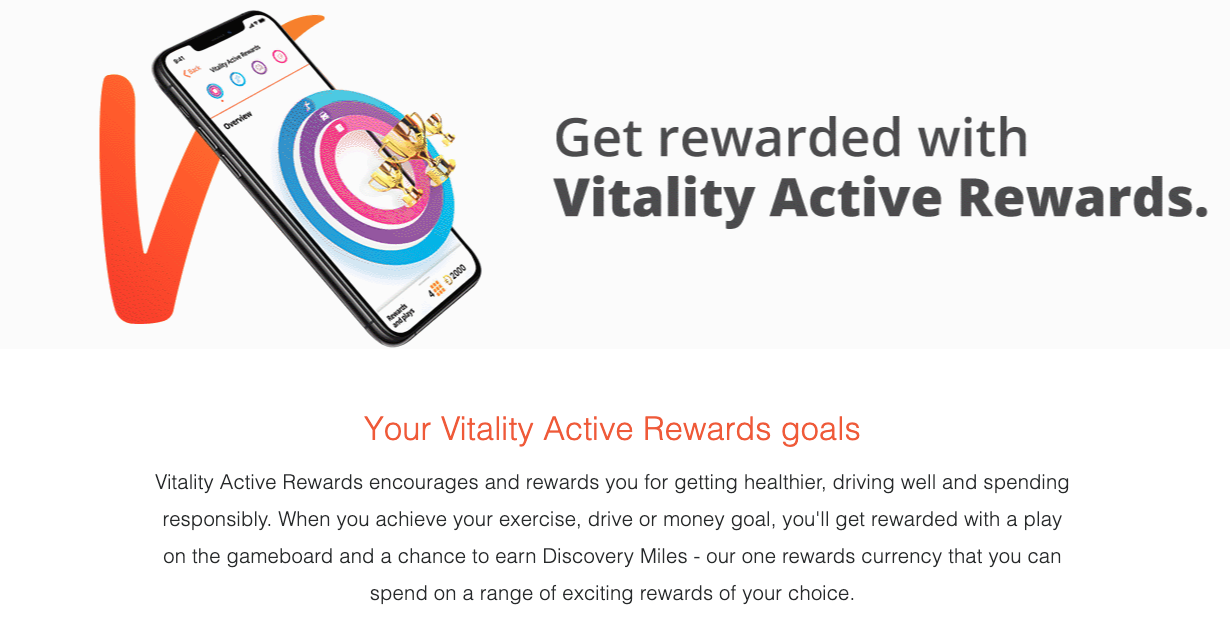

South Africa’s Discovery Vitality is a great example of how insurers can encourage healthy behaviour through incentives. Using a combination of discounts and rewards through a robust partner network, Vitality’s gamified points system rewards healthy habits like exercising and buying healthy food, are all trackable via fitness wearables and health apps. By encouraging preventative care, insurers not only reduce claims, but they also develop more authentic relationships with customers by showing real care for their health.

Source: Discovery

Using Big Data

We can’t talk about digital transformation without mentioning big data. And there’s a clear reason - Big Data is where everyone is heading because of its massive potential. In the insurance context there are already discussions around using Big Data to create personalised insurance models, based on a person’s social media behaviour. This will allow insurers to make better decisions about the underwriting and pricing of premiums. Analysing and making sense of such data, however, requires a range of capabilities within machine learning and data analytics, which are quite costly.

But there’s also a reason why it comes at the bottom of our list of benefits for the insurance sector. Using personal data creates many challenges and trust issues for both insurers and customers. In the wake of the 2018 Cambridge Analytica scandal and various public data breaches in recent years, consumers are quite sceptical about how their data is used and stored. Government regulators are also pushing harder for data ownership and transparency, and with fair points.

As a human-first digital agency, we have very strong beliefs about privacy and data protection and we are doing our best to be aware of the pitfalls of personalisation in health insurance. Diving into the Big Data wormhole can be quite tempting, but it should nevertheless be approached with a healthy dose of scepticism.

Ready to shake things up?

As we’ve discussed so far, there are many ways in which digitalisation can be used for the benefit of the health insurance industry. Hopefully, we’ve also made a strong case for why it should be harnessed. Optimising business processes, providing better customer experience and encouraging customers to lead a healthier lifestyle are only a few of the reasons.

We are strong believers that technology can be of use for both insurance customers and providers and we are looking for partners who share our belief. If you dream about shaking up the health insurance industry for the better, reach out to us. We have a proven track record working in the insurance sector with clients like UNIQA and BNP Pariba, and we can support you in clarifying and developing your project idea.